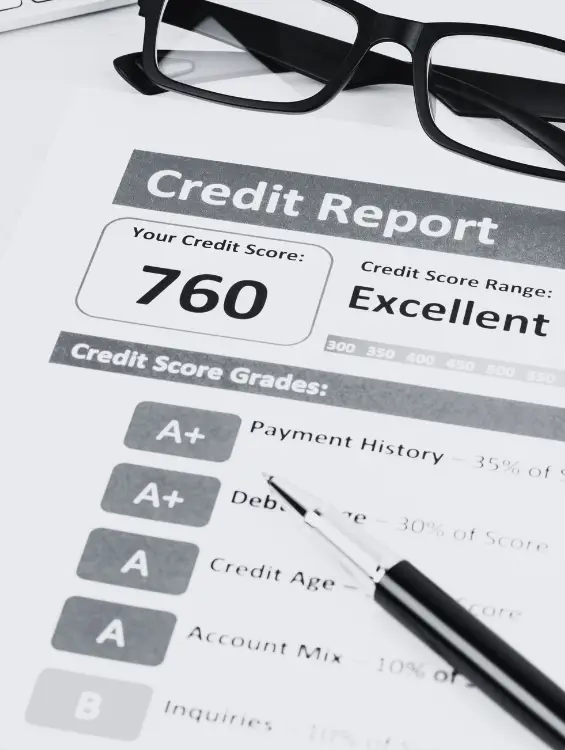

Score Recovery.Financial Freedom.

Credit Repair

We help individuals take control of their credit with ethical, transparent strategies to improve their credit reports and boost their scores. Whether you’re rebuilding after a financial setback or preparing for a major purchase, we’ll guide you step-by-step to fix errors, develop healthy habits, and make your credit work for you — not against you.

Report Accuracy

We help you identify and dispute inaccurate or outdated items.

Debt Strategy

We’ll guide you on how to tackle collections or high balances with confidence.

Score Building

You’ll learn how to use credit responsibly to improve your profile.

Credit Confidence

Understand your credit score, what affects it, and how to protect it.

Let’s get your credit headed in the right direction.

Whether your score is low or just not where you want it to be, we’ll help you build it step-by-step — no judgment, no confusion.

credit repair

What’s Included

We provide personalized credit repair support and education through:

- Credit Report Review – Detailed review of all 3 bureaus (Experian, Equifax, TransUnion)

- Dispute Guidance – We help prepare and submit disputes for inaccurate, unverifiable, or outdated items

- Debt Validation Requests – Learn how to request proof of debt and stop harassment from collectors

- Payoff Strategy Support – Understand which debts to prioritize and how to negotiate effectively

- Credit Education – Learn how credit works, what impacts your score, and how to build credit the right way

- Credit Monitoring Tools – Get recommendations on free and paid tools to track your progress

- Secured Card or Tradeline Planning – Explore credit-building products based on your goals

- Identity Protection Tips – Learn how to protect yourself from fraud and unauthorized activity

We follow legal and transparent practices only. This is not a quick-fix service — it’s an ethical path to long-term credit health.

F.A.Q.

Got questions? We've got answers.

We can help dispute items that are inaccurate, outdated, or unverifiable. We do not promise to remove valid negative marks.

It depends on your starting point. Some clients see progress within 30–90 days, but lasting results come from long-term habits.

We help you understand your rights, negotiate settlements, and stop harassment using legal tools.

Yes. We follow FCRA and CFPB guidelines. No shady tactics — only transparent, legal actions that protect you.

Yes — and we can guide you! Many of our clients use our support because they want expert help and accountability.

Ready to take control of your credit?

We’ll help you understand your score, fix what’s hurting you, and build what you need.

Contact us today and start building the credit you deserve.